What is a Professional Employer Organization (PEO) and how can it benefit your business?

- A Professional Employer Organization (PEO) is a comprehensive human resource outsourcing solution referred to as co-employment.

- Under this arrangement, the PEO assumes responsibility for handling a range of employee administration tasks, including payroll management and benefits administration, on behalf of a business.

While certain PEOs may offer additional strategic services, it is crucial to conduct thorough research on various providers and compare their capabilities, as each PEO is unique in its offerings

Why should you consider using a PEO?

- By leveraging the expertise and strategic guidance of a PEO, you can potentially foster business growth while ensuring greater protection. PEOs typically offer assistance in the following areas:

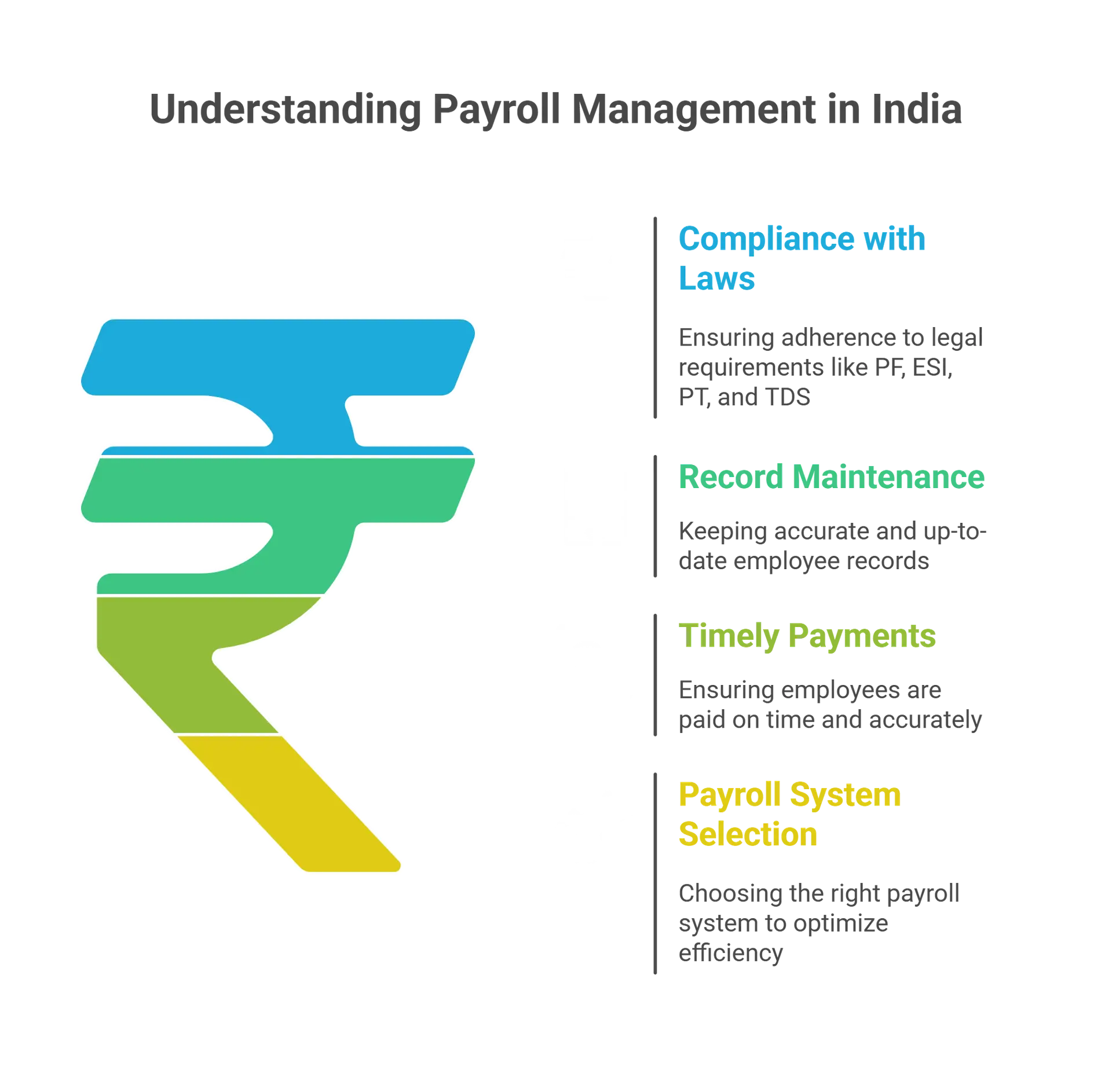

1. Payroll and tax filing:

- They handle payroll processing and, in some cases, take care of local, state, and federal employment tax payments. They often integrate payroll with time and attendance systems to minimize errors and duplicate data entry.

2. Benefits administration:

Under a co-employment arrangement, PEOs provide access to high-quality, cost-effective health insurance, dental care, retirement benefits, and other employee perks. They handle employee enrollment for these benefits and process insurance claims on your behalf.

3. Compliance:

- They have compliance experts who can help safeguard your business from fines and penalties. They possess knowledge in areas such as payroll tax law, reporting requirements, unemployment insurance, workers’ compensation, and HR compliance.

4. Risk and safety:

Moreover, besides providing workers’ compensation insurance, certain Professional Employer Organizations (PEOs) undertake safety audits and offer training initiatives aimed at reducing claims. They may also extend assistance in facilitating Occupational Safety and Health Administration (OSHA) inspections

5. Human resource support:

❖ Many PEOs have HR professionals who offer comprehensive HR services and support. If you already have an in-house HR team, the PEO collaborates with them both strategically and administratively.

6. Talent management:

Selected PEOs offer comprehensive talent services that encompass the entire employee lifecycle. These services encompass areas such as recruitment, strategic hiring, employee training and engagement, as well as performance management.

PEO for small businesses:

Small and mid-sized business owners often seek the assistance of PEOs to handle crucial and strategic HR management tasks, allowing them to focus on their core competencies of creating, enhancing, and selling their products and services. Discover the benefits that a PEO can offer to small businesses.

Mitigate employer liability:

By partnering with a PEO, you have the potential to reduce some of the liabilities associated with being an employer

Expand beyond HR administration:

Certain PEOs go beyond HR administration and provide data analytics and benchmarking services, which offer insights into your workforce. With access to the right data and HR expertise, you can effectively address critical questions such as:

- How does the compensation of certain employees compare to market standards?

- Which skill sets are the best fit for available job openings?

- Which departments require additional employees?

- How does your employee turnover rate compare to similar companies?

Having this type of information can help you refine your business practices, enhance employee retention, and decrease turnover rates.

Understanding how PEOs operate:

- In a co-employment arrangement, the business and the Professional Employer Organizations (PEOs) assume specific employer responsibilities together.

- The PEO takes care of processing payroll, handling payroll tax deductions and payments, managing workers’ compensation coverage, administering employee benefits, and offering guidance on human resources matters.

- This allows you to focus on day-to-day business operations such as delivering products and services to customers because making decisions regarding employee hiring or termination.

Choosing a professional employer organization (PEO)

While selecting a PEO please consider the following:

1. Track record and stability: Choose a financially stable PEO with a strong track record.

2. Customized solutions: Look for a PEO that meets your business and employee needs.

3. Industry references: Seek referrals from clients in your industry.

4. Support and compliance: Ensure the PEO offers comprehensive support and compliance expertise.

5. Geographic coverage: Verify that the PEO operates where your business does.

6. Accreditation and certification: Consider PEOs accredited by ESAC or certified by the IRS.

Which businesses benefit from PEOs?

PEOs benefit various businesses:

- Small and mid-sized businesses benefit the most.

- Hence,Larger organizations can also find value.

- PEOs serve multiple industries, including real estate, technology, healthcare, legal services, consulting, manufacturing, trades, insurance, wholesale, and nonprofits.

Benefits of working with a CPEO:

● Financial guarantee through annual bond for federal tax liabilities.

● Elimination of wage-base “restart” for certain federal payroll taxes.

● Renewed certification ensures consistent fiduciary standards and trust.

ESAC accreditation for PEOs:

- PEOs may also receive some recognition from ESAC.

- ESAC accreditation signifies financial stability, ethical conduct, and adherence to standards and regulations.