Introduction:

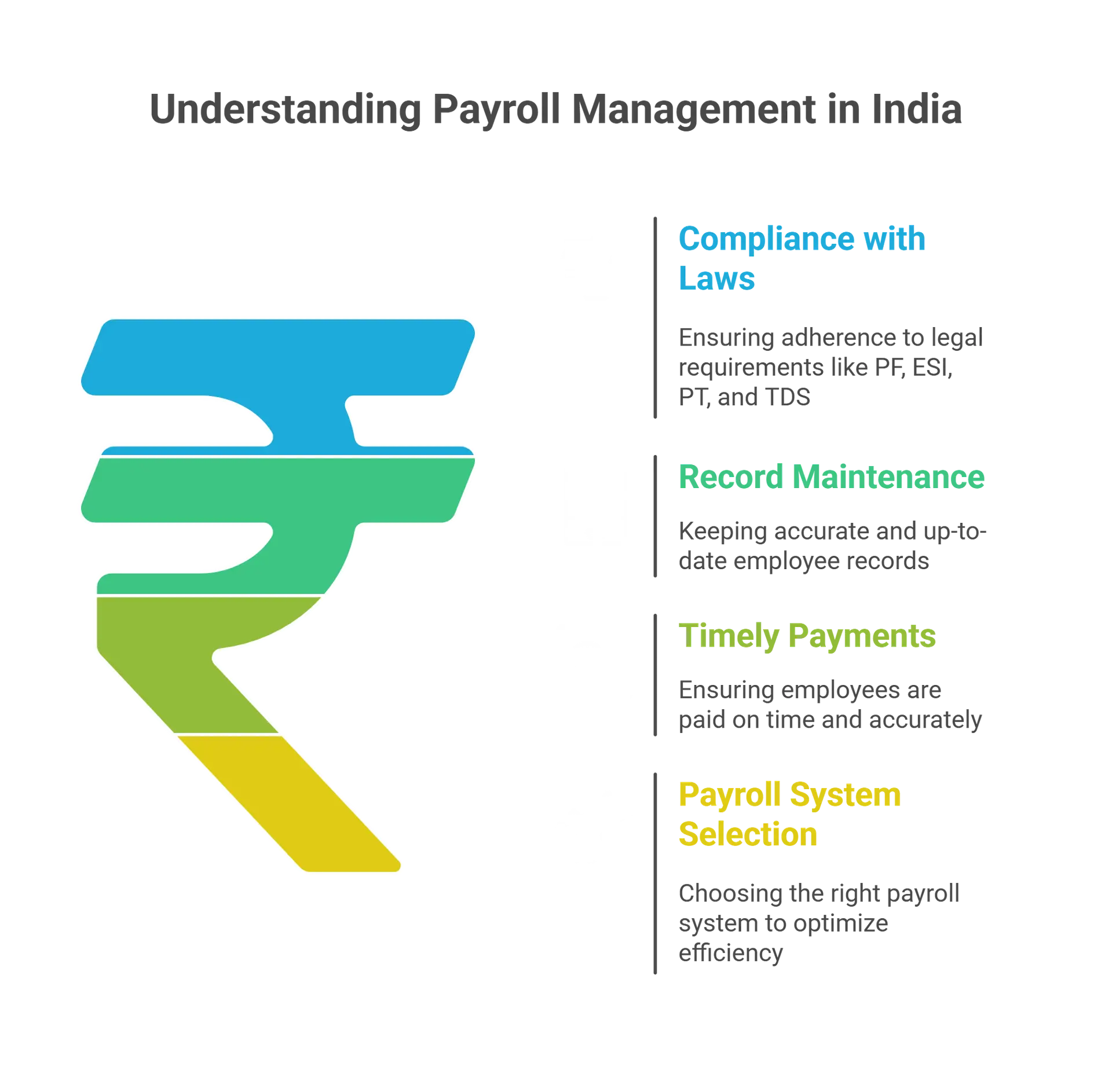

Payroll management in the realm of Human Resources (HR) refers to a vital function that entails the accurate and timely payment of employees. It encompasses the administration of financial records pertaining to employee salaries, wages, bonuses, and deductions.

Within the domain of payroll system, HR professionals assume responsibility for various tasks, including the calculation of employee salaries, the deduction of taxes, the management of employee benefits, and the distribution of payslips. Their primary objective is to guarantee the precise processing of payroll, ensuring that all employees receive their rightful compensation while adhering to legal and regulatory obligations.

In addition to its core functions, payroll system encompasses the meticulous maintenance of comprehensive employee compensation records, diligent management of payroll data and records, and the generation of insightful reports to analyze employee compensation trends and costs.

Ensuring effective payroll process is crucial for organizations to uphold employee satisfaction and trust, while also mitigating the risk of legal and financial repercussions resulting from non-compliance. Given its intricacies, successful payroll management necessitates a meticulous attention to detail and a profound comprehension of the regulations and requirements governing payroll processing.

Phases of the Payroll Management Process:

Pre-Payroll Phase:

- The initial stage of the payroll administration process involves establishing effective collaboration between the payroll department and other relevant departments.

- It is crucial to have well-defined policies in place, approved by the company’s management, to govern the payroll processing procedures.

- During this phase, input is gathered from various departments to ensure accurate calculation of payroll.

Actual Payroll management Phase:

Once the pre-payroll phase is completed, the payroll data is entered into the payroll system to initiate the actual processing.

- This phase involves the computation of net pay, taking into account applicable taxes and deductions.

- The system generates the final payment amount to be disbursed to employees.

Post-Payroll Phase:

- The post-payroll phase encompasses the necessary tasks following the payroll processing.

- During this phase, all relevant deductions, such as Employee Provident Fund (EPF), Tax Deducted at Source (TDS), and other related deductions, are subtracted from the employees’ pay.

- The deducted amount is then forwarded to the respective government agencies for further processing, either to be returned to the employees or to be reported as part of the Provident Fund (PF) return filing process.

Why is payroll management crutial?

Effective payroll management is essential for businesses as it brings several benefits:

- It boosts employee engagement by ensuring timely and accurate payment, showcasing the company’s commitment and fostering a positive work environment.

- It ensures compliance with legal and regulatory requirements, preventing penalties and reputational damage.

- Additionally, proper payroll process facilitates efficient record-keeping and reporting, aiding in budgeting, financial planning, and external audits.

- It also enables accurate tax withholding and reporting, ensuring compliance with tax laws and avoiding penalties.

- Moreover, streamlined payroll processes lead to cost savings by reducing administrative overhead, eliminating errors, and improving efficiency.

- By optimizing payroll, businesses can allocate resources effectively, enhance employee satisfaction, maintain compliance, and achieve cost efficiencies.

What are the six primary steps of payroll management?

Payroll management involves six key steps to ensure smooth and accurate processing:

1. Obtain an Employer Identification Number (EIN):

Obtain an EIN from the government to facilitate tax reporting and compliance.

2. Collect Employee Tax Documents:

Gather necessary tax documents from employees, such as W-4 forms, to determine tax withholding.

3. Establish a Payroll Schedule:

Set a clear payroll schedule to define the frequency of employee payments, whether weekly, bi-weekly, semi-monthly, or monthly.

4. Document Compensation Terms:

Thoroughly document employee compensation terms, including base salary, bonuses, deductions, benefits, and any special considerations.

5. Choose a Payroll management Method:

Select an appropriate payroll processing method, whether using software or outsourcing to a third-party provider, to ensure accurate and efficient payroll calculations.

6. Set Up a Payroll Bank Account:

Create a dedicated bank account exclusively for payroll transactions, ensuring clear separation and easy tracking of payroll funds.

By following these steps, businesses can streamline their payroll management processes, maintain compliance, and ensure accurate and timely payments to employees.

Significance of Payroll management:

The significance of payroll management in an organization cannot be overstated. Here are some key reasons why effective payroll management is crucial:

1. Legal Compliance:

Payroll operation ensures adherence to legal and regulatory requirements concerning employee compensation, taxes, and benefits. Compliance failure can lead to penalties and damage the organization’s reputation.

2. Financial Management:

Payroll plays a vital role in the overall financial management of an organization. It ensures efficient allocation and utilization of financial resources.

3. Record-Keeping:

Accurate maintenance of employee compensation, tax, and benefits records is a critical aspect of payroll management. These records provide valuable data for HR and financial decision-making, identifying trends and areas for improvement.

4. Strategic Planning:

Payroll data offers insights into workforce and financial performance, enabling informed decision-making on employee compensation, benefits, and related matters.

5. Employee Satisfaction:

Timely and error-free payroll processing is essential for maintaining employee satisfaction. Mistakes or delays can result in financial difficulties for employees and negatively impact morale.

In conclusion, effective payroll is essential for an organization’s legal compliance, employee satisfaction, financial management, record-keeping, and strategic planning within the HR function.

Conclusion

Efficient payroll management is a critical aspect of HR operations, enabling organizations to effectively handle employee payroll and associated responsibilities. NF is a trusted provider of comprehensive HR outsourcing services, offering a wide range of solutions encompassing HR management, including specialized expertise in payroll Process.