Introduction-Payroll Management

In the year 2023, our world has transformed into a tightly connected global community, breaking down the traditional boundaries of business operations. This shift has given rise to a new dimension of commerce, prompting significant industry expansion. However, this growth has brought about a distinct set of obstacles, most notably in the realm of payroll management for multinational corporations.

In this blog, we will explore the intricate dynamics involving international regulations, intricate tax structures, and compliance requirements. These are all essential elements that multinational enterprises, much like your own, need to navigate and master.

The legal intricacies and compliance challenges in this context can perplex even the most seasoned experts. In this piece, we will shed light on strategies and solutions designed to demystify these hurdles.

Join us as we embark on a journey through the complex landscape of international finance. This landscape transcends borders and plays a pivotal role in shaping the future of multinational enterprises.

Navigating International Regulations:

- In the global business landscape, borders are becoming less significant, and opportunities extend across continents.

- Efficient payroll management is crucial for a business’s success.

Understanding Regulatory Challenges:

- Global payroll management is akin to solving a complex puzzle, where each piece represents a different jurisdiction.

- These jurisdictions include labor laws governing overtime and tax regulations affecting withholdings.

- Some companies are turning to crypto payments and blockchain technology to ensure compliance with diverse regulations.

Toku as a Pioneering Platform:

- Toku is a centralized platform for token payroll that leverages blockchain technology.

- It offers tamper-free transactions, accurate tax calculations, and tax withholdings.

- Toku ensures maximum transaction security and compliance with all relevant laws.

Regulatory Insights:

- Global payroll management involves understanding a multitude of rules specific to each nation.

- To manage these intricacies, businesses should use technology to gain insights.

- Strategies include data-driven insights through analytics, collaborating with local experts for real-time updates, and maintaining a central repository of compliance documentation.

A Compliance-Driven Future:

- Dealing with international regulations now requires proactive strategies rather than reactive adjustments.

- Compliance can give businesses a competitive advantage in the market.

- Failing to follow regulations can result in significant financial penalties, as demonstrated by the $7 billion in penalties collected by the IRS in the 2022 fiscal year.

Leveraging Technology for Real-Time Insights:

- Advancements in technology allow businesses to respond proactively to regulatory changes.

- This proactive approach helps avoid unnecessary fees or penalties and maintains the flexibility of payroll systems.

Global stock options and expensing:

The appeal of stock options has consistently transcended international boundaries, offering multinational corporations both opportunities and challenges.

The Promise of Stock Options:

- Stock options are appealing to multinational companies as they offer opportunities and complexities.

- Offering stock options to employees can boost loyalty by aligning their success with the company’s performance.

- Factors to consider include ensuring equity plans work across different regions, transparent communication about stock options, and collaboration with tax experts to handle tax implications.

Strategies for a Global Landscape:

- Dealing with global stock options requires adaptability and awareness of tax laws and financial regulations.

- Recommended strategies include monitoring regulatory changes, aligning equity programs with business objectives, educating stakeholders about global stock options, understanding cross-border taxation, and maintaining transparent communication with employees.

- Implementing these strategies can help businesses navigate the complexities of global stock options effectively.

Empowering the Global Workforce:

- Expensing stock options goes beyond financial numbers; it empowers employees by giving them a sense of ownership.

- Stock options can enhance creativity, commitment, and innovation within a global workforce, fostering a culture of shared prosperity.

In summary, stock options provide opportunities for multinational companies, but they require careful consideration, transparency, and adaptability to navigate the complexities of global regulations. Implementing strategies and empowering the workforce through stock options can be a powerful tool for enhancing company performance and fostering a culture of shared success.

Building a Multinational Workforce:

- In the modern business world, innovation has no geographical boundaries.

- The online digital environment allows organizations to connect with talent globally and create success through a diverse multinational workforce.

Casting a Wide Net:

- Technology has expanded the global talent search beyond traditional boundaries.

- Organizations are now looking internationally for top-tier talents with diverse expertise and fresh perspectives to enrich problem-solving and innovation.

Strategic Recruitment:

- Recruitment is no longer limited by borders; it’s a global exploration of untapped potential.

- Effective recruitment techniques include crafting global narratives, adapting to local nuances while maintaining a unified philosophy, and leveraging technology for virtual engagement to bridge geographical gaps.

Creating a Fair Ecosystem:

- Building a multinational workforce goes beyond talent acquisition; it involves nurturing an inclusive ecosystem that fosters growth.

- Providing ongoing training and encouraging collaboration and continuous learning among employees is essential.

- Leading by example and promoting mutual learning can contribute to a culture of shared knowledge.

- Implementing mentorship programs that pair experienced team members with newcomers can ensure a smooth integration process and foster a sense of belonging in the team.

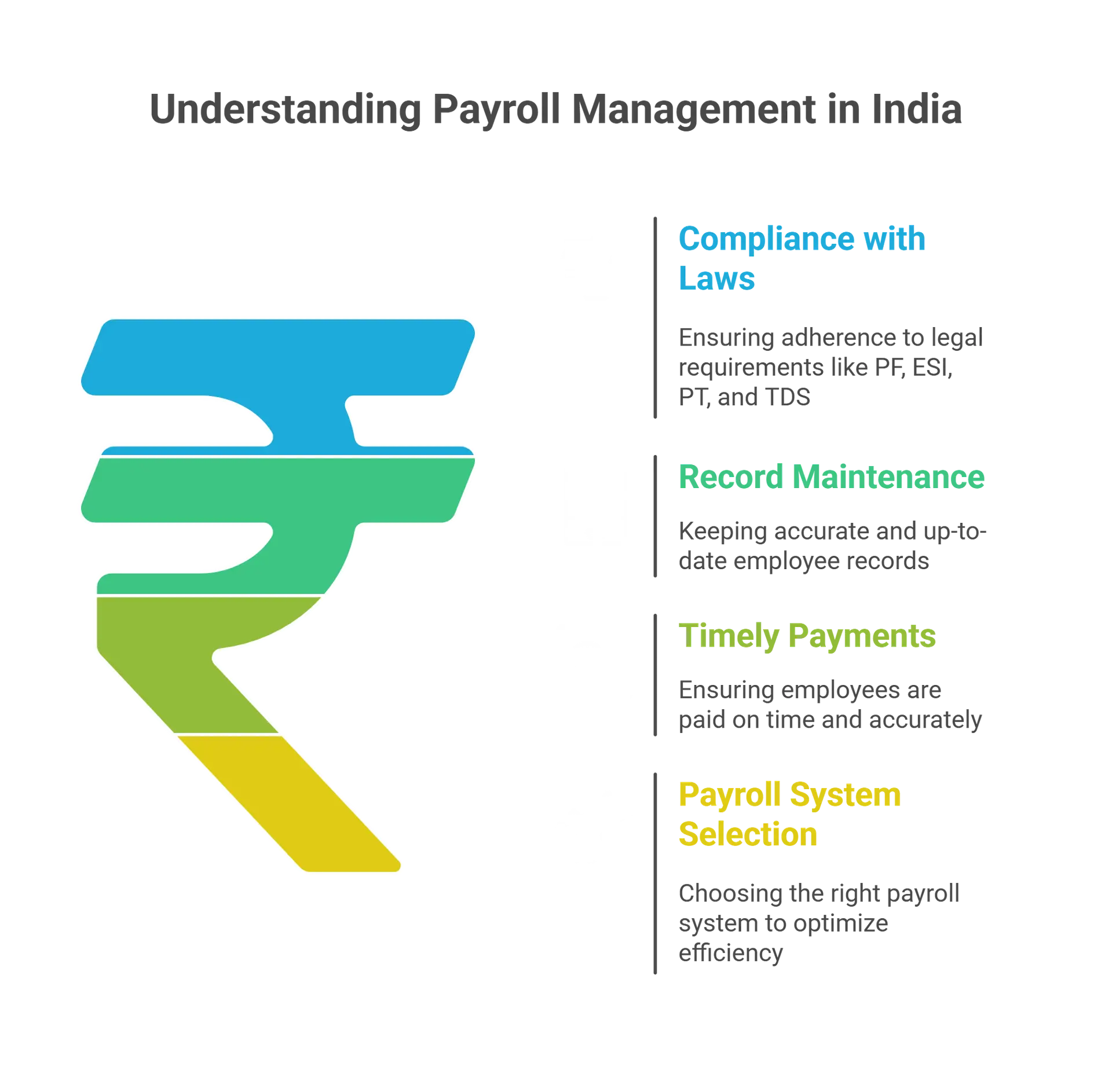

Compliance in global payroll management

Compliance Challenges for Multinational Companies:

Multinational companies face the complex task of understanding and adhering to various compliance requirements in different countries, including overtime regulations and tax intricacies. Non-compliance can lead to legal disputes, financial penalties, and damage to the company’s reputation.

Solutions for Ensuring Compliance:

1. Local Expertise: Collaborate with local experts who possess in-depth knowledge of each jurisdiction’s regulations.

2. Unified Compliance Framework: Develop a unified framework that aligns with the company’s global vision while respecting local norms to ensure consistency and minimize risks.

3. Technology and Automation: Implement technology-driven solutions to automate compliance monitoring, reduce errors, and ensure adherence to regulations.

Additional solutions include advanced payroll software, data security protocols, regular audits, scenario planning for potential compliance challenges, and staying updated on regulatory changes through monitoring and industry participation.

Global Payroll for Modern Organizations:

Navigating regulations and tapping into global talent is a top priority. Strategic foresight, tech-driven compliance, and fairness fuel innovation, expanding your business beyond imagination. Embrace global payroll for a compelling vision and progress.